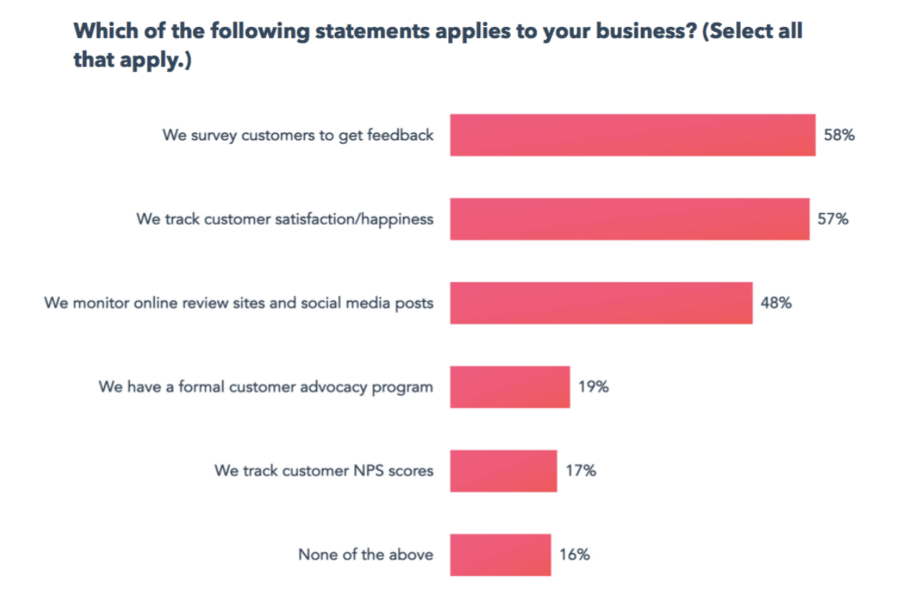

In 2019, Hubspot ran a survey to understand how and whether companies collect customer feedback.

It’s noticeable that 42% of companies don’t track customer feedback at all. This corresponds with the data we’ve found at Scale Coach. We regularly run a checklist tool with our member companies, called ‘The Rockefeller Habits Checklist’. Of the 10 questions asked, on average, the lowest score teams gave themselves in 2020 was for item #6 – ‘Reporting and analysis of customer feedback data is as frequent and accurate as financial data’, with some teams even giving themselves 0/10 scores.

Why is it so hard for companies to actually collect any customer feedback, let alone quality feedback? Most teams agree that it’s important and would be valuable, yet it just doesn’t get done. We see 3 common scenarios:

Most companies, when approaching the issue of customer feedback, tend to think of it from just one angle: ‘we need to assess how well our team is doing in delivering our products / services’. The focus is on assessment of team performance. This is of course a key component, but it misses a great opportunity: done well, quality customer feedback provides valuable data for use in sales & marketing. The key is to be able to demonstrate proof of delivery on the promises you’re making to the market.

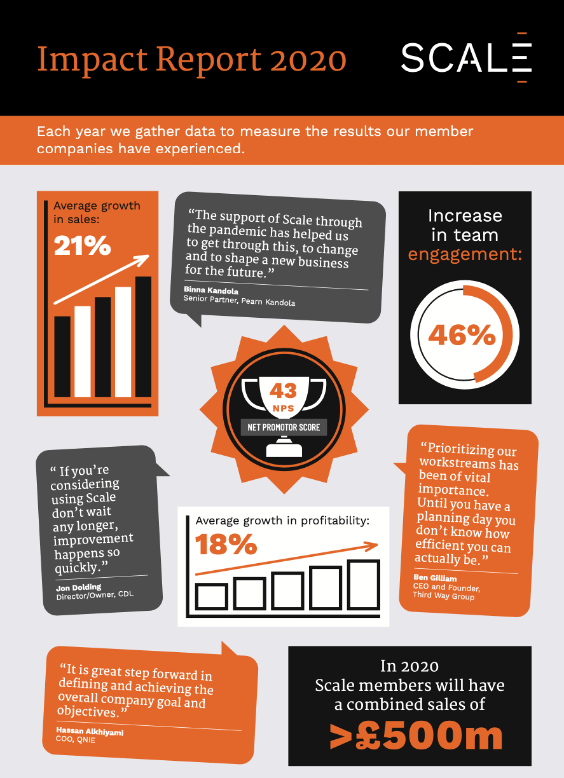

We stick to this principle ourselves at Scale. Once a year, we produce our ‘Impact report’.

As you can see, it is a summary of customer survey data, but it’s been asked and presented in a way that is also valuable when communicating with the market and potential new customers.

This connection is often missed – that customer feedback survey data has value as part of sales and marketing – because it requires some careful thought about how to actually go about collecting the feedback, and consistency / joined up thinking so that what is promised at the outset, is what is measured at the end.

Here is a blueprint or framework on how to go about collecting the customer feedback.

Simply follow this format, and use this worksheet, and you will ask yourself why you didn’t do this sooner.

First and foremost, there has to be a clear company strategy and positioning, built around consistently delivering on one or a few promises. This concept is often called ‘Brand Promise’, and is best understood with examples such as FedEx, where the company was built on a simple promise of providing next day delivery. Delivering on that key promise becomes the focus of all the investment, product development, and systems and processes of the organisation.

For example, we work with a telemetry business that provide monitoring solutions to water and waste-water networks. They are building the business around one very clear promise: ‘No escapes’ i.e. that their products and services will help water utilities achieve zero leakages and spills from their networks. This type of strategic clarity is crucial to be able to effectively gather customer feedback

You won’t get far unless it’s clear who actually owns the collection of customer feedback within the team. There is no one correct answer to this, we’ve seen it collected by customer service teams, marketing depts, sales teams, and the project managers responsible for client delivery. The key thing is to decide who’s going to be accountable for it.

At a practical level, you need to decide how the questions are going to be sent to and filled out by customers. Unless you have very few customers, this will typically involve some kind of survey tool. There are many simple and easy to use ones, such as SurveyMonkey or Typeform, and specialist platforms for things like NPS. You can also build / add extensions to CRM software that can perform this function.

However, there is an important caveat here. Customer are much less likely to fill out a survey if they feel it’s just been spewed out automatically. Fill out rates are much higher from personal emails from someone they’ve interacted with (even if that email is template and automated). So the best solution is to send an email containing a survey link from someone in the team that has had direct engagement with the customer.

It must take no longer than 2-3 minutes to fill out. Anything more than this and people simply won’t take the time. This means you have a realistic cap of just 6-7 questions, inc. a max of just 1 qualitative one (see below for specific suggestion on what those questions should be).

Sticking within this limit requires some discipline, as often different stakeholders in the business have multiple requirements of what should be asked in customer feedback surveys. The team must agree to a strict rule that if a question is added, then another must be removed, so that this limit is not breached.

First, understand that there are 4 types of questions you can ask:

The mistake that most companies make are that they ask too many hygiene, satisfaction, and qualitative questions, and not enough promise delivery ones. Essentially, they make it all about themselves (do you like me?), and not enough about whether they actually delivered the hoped-for change and benefits for the customer.

The correct mix of questions should be:

So, as you can see, the focus needs to be on the promise delivery questions. These can be challenging to get right, so here are a few examples:

You can start to solve this today. Sit down with the relevant teams and work through this worksheet.