Many business owners work hard to grow their businesses, to generate greater sales and profits. Sooner or later though, they end up realising that this approach – focusing principally on growth – is not enough.

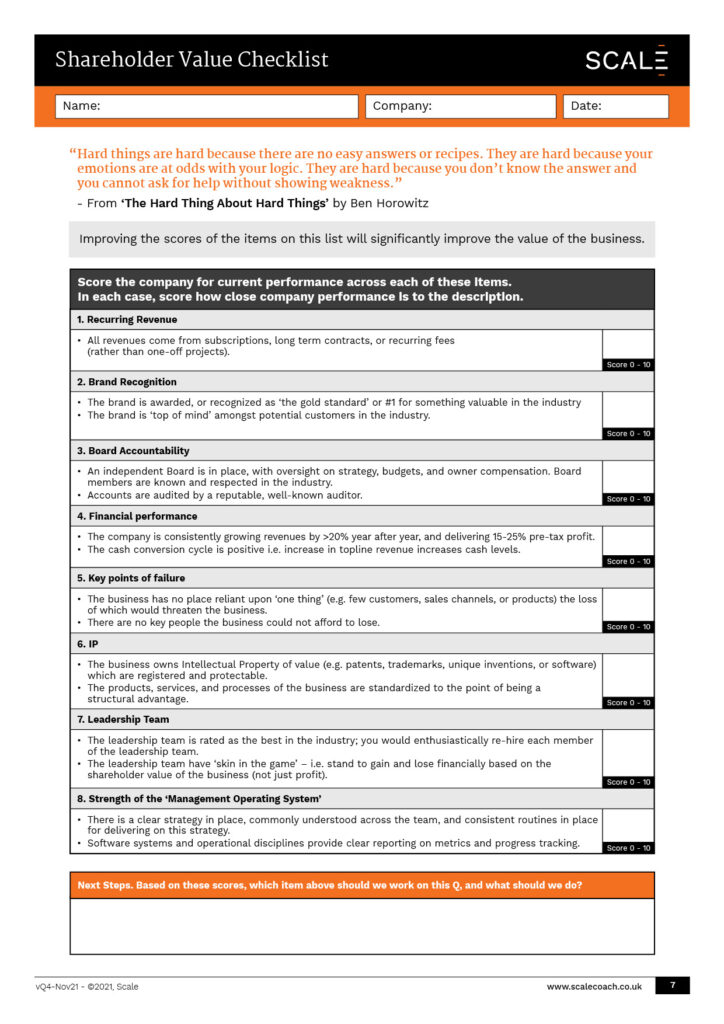

For example, take two businesses, with the same sales and profit, but one with entirely recurring revenue, and one having to wipe the slate clean and make new sales each month. From an investors’ perspective, these two businesses will have very different values. This is an example of Shareholder value vs simple size.

I learned this lesson the hard way. I had a business for several years that I enjoyed, felt a strong sense of purpose for, and that was consistently growing year on year. I never gave much thought to exit or how I would hand it over. But personal circumstances overtook me, and I found myself in a position to have to sell it, without the company really being ready. The sale didn’t realise the full value of that business, and within 6 months the brand was gone, the team dispersed, and the clients all folded into the acquirer.

We all reach a point in life where we have to think about legacy – what are we going to hand over when our work is done? Sometimes this happens when we’re old enough to retire, and sometimes, as in my case, much sooner. Even if this date is a long way off, the things that an investor would look at in your business are the same ones that will grow value for you – it’s about maximising the company for Shareholder Value, which important, because:

So why don’t more entrepreneurs have a stronger focus on building Shareholder Value? What we see again and again are the following reasons. Do any apply to you?

Let me be clear – it takes years to really grow Shareholder Value. Even if you have the notion to sell the company ‘in a few years time’, the process of development must start now.

It also pays to take others on the journey with you, having key members of the team (or even the wider team) incentivised by shareholding rather than just sales or profit will align incentives, and create a sense of ownership.

The process is simple (but not easy):

If done right, some of the initiatives you choose will take time, and may require significant investment to achieve. For example, transitioning to recurring revenue, or diversifying away from a single point of failure are really tough things to achieve if not there already. The key is to keep setting objectives and planning out projects each quarter. That habit breaks down an ‘insurmountable’ objective into achievable sprints.

What will happen during this journey, is that your mindset will shift from being a manager of your business, to being an owner / investor. You will start to realise that investing back into the business in key areas will end up paying dividends, and you will start to see each project in terms of ROI, with the “R” being measured in shareholder value.

Interested to talk through any of these ideas?

Get in touch @ andy@scalecoach.co.uk

Get updates on special events.

Website design by PATTEN DESIGN